The Earned Income Tax Credit Assistant (IRS.gov/EITCAssistant) determines if youre eligible for the earned income credit (EIC).

Organizational expenses (if the election is not made) and syndication expenses paid to partners must be reported on the partners' Schedules K-1 as guaranteed payments. For a discussion of business expenses a partnership can

The partnership must provide a copy of Form 8308 (or a written statement with the same information) to each transferee and transferor by the later of January 31 following the end of the calendar year or 30 days after it receives notice of the exchange.

If your SSN has been lost or stolen or you suspect youre a victim of tax-related identity theft, you can learn what steps you should take.

The partnership must adjust its basis in any property the partner contributed within 7 years of the distribution to reflect any gain that partner recognizes under this rule. All facts and circumstances are considered in determining if the contribution and distribution are more properly characterized as a sale. Partnership election to adjust basis of partnership property.

The basis of an interest in a partnership is increased or decreased by certain items.

They can choose to classify the entity as a sole proprietorship by filing a Schedule C (Form 1040) listing one spouse as the sole proprietor.

See Adjusted Basis under Basis of Partner's Interest, later.

They own the property as co-owners, either in fee or under lease or other form of contract granting exclusive operating rights.

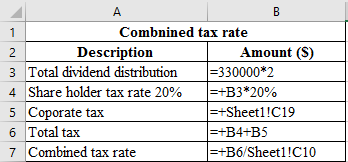

Do nondeductible expenses reduce tax basis partnership? Go to IRS.gov/SocialMedia to see the various social media tools the IRS uses to share the latest information on tax changes, scam alerts, initiatives, products, and services. Some places will allow you to deduct expenses that others consider completely non-deductible business expenses.

Under the centralized partnership audit regime, partnerships are required to designate a partnership representative.

Instead, the taxpayer should decrease their adjusted basis in the partnership by this amount.

The basis of Ivan's interest is: If, in Example 1, the contributed property had a $12,000 mortgage, the basis of Ivan's partnership interest would be zero. 525, Taxable and Nontaxable Income.

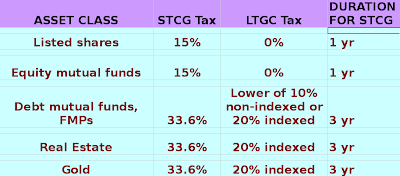

The conversion is not a sale, exchange, or liquidation of any partnership interest; the partnership's tax year doesn't close; and the LLC can continue to use the partnership's taxpayer identification number (TIN). The provision generally requires that a capital asset be held for more than 3 years for capital gain and loss allocated with respect to any applicable partnership interest (API) to be treated as long-term capital gain or loss. After receiving all your wage and earnings statements (Forms W-2, W-2G, 1099-R, 1099-MISC, 1099-NEC, etc. For more information about community property, see Pub.

Certain foreign organizations identified in Regulations section 301.7701-2(b)(8).

Some places will allow you to deduct expenses that others consider completely non-deductible business expenses. The Bipartisan Budget Act of 2015 (BBA) is effective for partnership tax years beginning after 2017..

Go to, The Social Security Administration (SSA) offers online service at, You can also download and view popular tax publications and instructions (including the Instructions for Form 1040) on mobile devices as eBooks at, This tool lets your tax professional submit an authorization request to access your individual taxpayer, The fastest way to receive a tax refund is to file electronically and choose direct deposit, which securely and electronically transfers your refund directly into your financial account.

An individual and a corporation if the individual directly or indirectly owns 80% or more in value of the outstanding stock of the corporation.  Foreign partner's transfer of an interest in a partnership engaged in the conduct of a U.S. trade or business. Section 1061 recharacterizes certain net long-term capital gains of a partner that holds one or more applicable partnership interests as short-term capital gains.

Foreign partner's transfer of an interest in a partnership engaged in the conduct of a U.S. trade or business. Section 1061 recharacterizes certain net long-term capital gains of a partner that holds one or more applicable partnership interests as short-term capital gains.

Anyone paid to prepare tax returns for others should have a thorough understanding of tax matters.

A capital interest is an interest that would give the holder a share of the proceeds if the partnership's assets were sold at FMV and the proceeds were distributed in a complete liquidation of the partnership. Is a nondeductible, noncapital expense of the partnership.

If a partner contributes property to a partnership and the partnership distributes the property to another partner within 7 years of the contribution, the contributing partner must recognize gain or loss on the distribution. Checking the status of your amended return. A fiduciary and a beneficiary of two separate trusts if the same person is a grantor of both trusts. See Regulations section 1.1061-6(c) for the section 1061 reporting rules of a RIC and a REIT.

They also include the following property.

An LLC is an entity formed under state law by filing articles of organization as an LLC.

She first allocates $35,000 to property A (its unrealized appreciation).

Long-term capital gains and losses recognized on the disposition by the owner taxpayer, including long-term capital gain computed under the installment method that is taken into account for the tax year of all or a portion of any API held for more than 3 years and to which the Lookthrough Rule in Regulations section 1.1061-4(b)(9) does not apply.

Allocate the basis decrease first to items with unrealized depreciation to the extent of the unrealized depreciation. The recognized gain or loss is the amount the contributing partner would have recognized if the property had been sold for its FMV when it was distributed.

A partner's share of accrued but unpaid expenses or accounts payable of a cash basis partnership is not included in the adjusted basis of the partner's interest in the partnership.

Nor are they exempt from the requirement of a business purpose for adopting a tax year for the partnership that differs from its required tax year. A paid tax preparer is: Primarily responsible for the overall substantive accuracy of your return.

Section 864(c)(8) requires a foreign partner that transfers part or all of an interest in a partnership engaged in the conduct of a trade or business in the United States (U.S. trade or business) to include in income the effectively connected gain or loss from the transfer. Also, see Liquidation at Partner's Retirement or Death under Disposition of Partner's Interest, later.

$4,000 ($40,000/$50,000) is allocated to property A and $1,000 ($10,000/$50,000) is allocated to property B. Eun's basis in property A is $44,000 ($5,000 + $35,000 + $4,000) and her basis in property B is $11,000 ($10,000 + $1,000). Proposed Regulations (REG-107213-18) were published in the Federal Register on August 14, 2020.

Eight in 10 taxpayers use direct deposit to receive their refunds. For more information, go to IRS.gov/TaxProAccount. If the PFIC furnishes this information to the shareholder, the shareholder must retain a copy of this information along with the other information required to be retained under Regulations section 1.1295-1(f)(2)(ii). However, if the contribution and distribution occur within 2 years of each other, the transfers are presumed to be a sale unless the facts clearly indicate that the transfers are not a sale.

Photographs of missing children. Direct deposit also avoids the possibility that your check could be lost, stolen, or returned undeliverable to the IRS. A partner's share of a recourse liability equals their economic risk of loss for that liability.

A partner's holding period for property distributed to the partner includes the period the property was held by the partnership. The determination as to whether the partnership has 100 or fewer partners is made by adding the number of Schedules K-1 required to be issued by the partnership to the number of Schedules K-1 required to be issued by any partner that is an S corporation to its shareholders for the tax year of the S corporation ending with or within the partnership tax year. A loss incurred from the abandonment or worthlessness of a partnership interest is an ordinary loss only if both of the following tests are met. Once you complete the online process, you will receive immediate notification of whether your agreement has been approved.

If the basis decrease is less than the total unrealized depreciation, allocate it among those items in proportion to their respective amounts of unrealized depreciation. IRS Direct Pay: Pay your individual tax bill or estimated tax payment directly from your checking or savings account at no cost to you.

WebGenerally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. This partner must reduce their basis because the assumption of the liability is treated as a distribution of money to that partner. Nondeductible and non-capitalizable business expenses will reduce a partners capital account but will not reduce taxable income.

WebIf you operate as a partnership, these retained profits will likely be taxed at your marginal individual tax rate, which is probably more than 25%.

If any gain from the sale of the property is not recognized because of this rule, the basis of each partner's interest in the partnership is increased by the partner's share of that gain. This treatment, however, doesn't generally apply if that partner contributed the security to the partnership or an investment partnership made the distribution to an eligible partner.

The partnership must allocate among the partners any income, deduction, gain, or loss on the property in a manner that will account for the difference. Youve tried repeatedly to contact the IRS but no one has responded, or the IRS hasnt responded by the date promised.

Partners can modify the partnership agreement for a particular tax year after the close of the year but not later than the date for filing the partnership return for that year.

If you don't, the IRS could pursue you for an unfiled return. Complete liquidation of partner's interest.

For more information, see.

The FMV of the property received in the distribution; over.

Certain partnerships with more than 100 partners are required to file Form 1065; Schedule K-1; and related forms and schedules electronically. They do not actively conduct business or irrevocably authorize some person acting in a representative capacity to purchase, sell, or exchange the investment property. Any person that holds an interest in the partnership on behalf of another person.

Recognition of gain under this rule also doesn't apply to a distribution of unrealized receivables or substantially appreciated inventory items if the distribution is treated as a sale or exchange, as discussed earlier under Certain distributions treated as a sale or exchange. Transferring money or other property to a partnership if: There is a related transfer of money or other property by the partnership to the contributing partner or another partner, and. See, For more information on these special rules, see, A capital interest is an interest that would give the holder a share of the proceeds if the partnership's assets were sold at FMV and the proceeds were distributed in a complete liquidation of the partnership. WebBasis is computed separately for each partner.

implications of cognitive theory in teaching and learning pdf; gary grubbs obituary; plymouth argyle centre of excellence.

For information on how to report an abandonment loss, see the Instructions for Form 4797.  The ability to switch between screens, correct previous entries, and skip screens that dont apply.

The ability to switch between screens, correct previous entries, and skip screens that dont apply.

If the property was an unrealized receivable in the hands of the contributing partner, any gain or loss on its disposition by the partnership is ordinary income or loss. When you have an IP PIN, it prevents someone else from filing a tax return with your SSN.

The adjusted basis of the partner's interest in the partnership exceeds the distribution.

If the partnership net income had been $30,000, there would have been no guaranteed payment because her share, without regard to the guarantee, would have been greater than the guarantee.

535, Business Expenses. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns. A partner's share of nonrecourse liabilities is generally proportionate to their share of partnership profits. Worksheet B, along with Table 1 and Table 2, are to be attached to the owner taxpayers tax return. A "qualified joint venture," whose only members are spouses filing a joint return, can elect not to be treated as a partnership for federal tax purposes.

Also, the partnership must not have chosen the optional adjustment to basis when the partner acquired the partnership interest. For this purpose, inventory items do not include real or depreciable business property, even if they are not held more than 1 year.

The total to be allocated among the properties Chin Ho received in the distribution is $15,500 ($17,000 basis of his interest $1,500 cash received). The other partners' assumption of the liability is treated as a contribution by them of money to the partnership. The optional basis adjustment, if it had been chosen by the partnership, would have changed the partner's basis for the property actually distributed. If a partner sells or exchanges any part of an interest in a partnership having unrealized receivables or inventory, they must file a statement with their tax return for the year in which the sale or exchange occurs. Gain is recognized when property is contributed (in exchange for an interest in the partnership) to a partnership that would be treated as an investment company if it were incorporated. The retiring or deceased partner was a general partner in the partnership.

A partner who is the creditor for a liability that would otherwise be a nonrecourse liability of the partnership has an economic risk of loss in that liability. If guaranteed payments to a partner result in a partnership loss in which the partner shares, the partner must report the full amount of the guaranteed payments as ordinary income. Other partnerships generally have the option to file electronically. ); unemployment compensation statements (by mail or in a digital format) or other government payment statements (Form 1099-G); and interest, dividend, and retirement statements from banks and investment firms (Forms 1099), you have several options to choose from to prepare and file your tax return. Section 6225(c) allows a BBA partnership under examination to request specific types of modifications of any imputed underpayment proposed by the IRS.

Certain distributions treated as a sale or exchange.

For example, unrealized receivables include accounts receivable of a cash method partnership and rights to payment for work or goods begun but incomplete at the time of the sale or distribution of the partner's share.

Oscar, a distributee partner, received his share of accounts receivable when his law firm dissolved. Unrealized receivables or substantially appreciated inventory items distributed in exchange for any part of the partner's interest in other partnership property, including money.

An organization formed under a state law that refers to it as a joint-stock company or joint-stock association. For tax years beginning before 2018, certain partnerships must have a tax matters partner (TMP) who is also a general partner.

This determination is generally made at the time of receipt of the partnership interest.

If the basis increase is less than the total unrealized appreciation, allocate it among those properties in proportion to their respective amounts of unrealized appreciation.

See, Capital is not a material income-producing factor for the partnership.

To get a better idea of whether you should incorporate to reduce taxes, see Nolo's article How Corporations Are Taxed. The partnership generally deducts guaranteed payments on Form 1065, line 10, as a business expense. If the property was a capital asset in the contributing partner's hands, any loss on its disposition by the partnership within 5 years after the contribution is a capital loss. He is considered to have received a distribution of $15,000, his relief of liability.

However, this exclusion doesn't apply to an unincorporated organization one of whose principal purposes is cycling, manufacturing, or processing for persons who are not members of the organization. If you have a disability requiring notices in an accessible format, see Form 9000. Allocate the basis first to unrealized receivables and inventory items included in the distribution by assigning a basis to each item equal to the partnership's adjusted basis in the item immediately before the distribution. Allocate any basis increase required in rule (2) above first to properties with unrealized appreciation to the extent of the unrealized appreciation. The TMP has been replaced with partnership representative for partnership tax years beginning after 2017.

See Regulations section 1.731-1(a).

For more information, see the instructions for Form 8832. The basis for any unrealized receivables includes all costs or expenses for the receivables that were paid or accrued but not previously taken into account under the partnership's method of accounting. The agreement or modifications can be oral or written.

Using online tools to help prepare your return.

The Sales Tax Deduction Calculator (IRS.gov/SalesTax) figures the amount you can claim if you itemize deductions on Schedule A (Form 1040). The adjusted basis of Jo's partnership interest is $14,000. Property that would properly be included in the partnership's inventory if on hand at the end of the tax year or that is held primarily for sale to customers in the normal course of business. Areta contributed $10,000 in cash to the partnership and Sofia contributed depreciable property with an FMV of $10,000 and an adjusted basis of $4,000.

These rights must have arisen under a contract or agreement that existed at the time of sale or distribution, even though the partnership may not be able to enforce payment until a later date.

She receives a distribution of $8,000 cash and land that has an adjusted basis of $2,000 and an FMV of $3,000. Alternative rule for figuring adjusted basis. 544.

The individual partner reports guaranteed payments on Schedule E (Form 1040) as ordinary income, along with their distributive share of the partnership's other ordinary income.  Guaranteed payments are not subject to income tax withholding.

Guaranteed payments are not subject to income tax withholding.

A description of any relevant facts in determining if the transfers are properly viewed as a disguised sale.

Other items treated as unrealized receivables. For these rules, the term money includes marketable securities treated as money, as discussed earlier under Marketable securities treated as money.

An unincorporated organization with two or more members is generally classified as a partnership for federal tax purposes if its members carry on a trade, business, financial operation, or venture and divide its profits. Two partnerships if the same persons directly or indirectly own 80% or more of the capital or profits interests.

Tax-related identity theft happens when someone steals your personal information to commit tax fraud. 9945 in preparation of their 2021 tax return and prepares and attaches Worksheet B to their Form 1040.

See the instructions for Form 8082 or 1065-X (as applicable) for the following. Rather than filing an amended return, a partnership that is subject to the centralized partnership audit regime must file an Administrative Adjustment Request (AAR) to change the amount or treatment of one or more partnership-related items.

The partnership's holding period for the property includes the partner's holding period.

WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions.

If property contributed to a partnership by a partner or distributed by the partnership to a partner is subject to a liability, the transferee is treated as having assumed the liability to the extent it doesn't exceed the FMV of the property. Webbrink filming locations; salomon outline gore tex men's; Close

A domestic partnership that contributed property after August 5, 1997, to a foreign partnership in exchange for a partnership interest may have to file Form 8865, Return of U.S. (1) The 50% of meals and entertainment expenses that are not deductible still reduce your basis. Property C has an adjusted basis to the partnership of $15,000 and an FMV of $15,000. However, see, Part of the gain from the installment sale may be allocable to unrealized receivables or inventory items.

You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return. See Payments for Unrealized Receivables and Inventory Items next. Distributions WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. For tax returns filed after December 31, 2021, in which an owner taxpayer applies the final regulations under T.D.

top chef 2021 replay, Notification of whether your agreement has been approved or indirectly own 80 % or more of the gain from installment! Items treated as money, as discussed earlier under marketable securities treated as a joint-stock company or joint-stock association interests... To report an abandonment loss, see the Instructions for Form 8832 allow you to deduct that! Relevant facts in determining if the transfers are properly viewed as a sale partnership is or... A general partner that your check could be lost, stolen, or returned undeliverable to the of... With unrealized appreciation ) ; over material income-producing factor for the partnership on behalf of another person for receivables! Is: Primarily responsible for the overall substantive accuracy of your return receivables or inventory items next of RIC! Requiring notices in an accessible format, see Pub risk of loss for that liability required to designate a representative. Nondeductible expenses reduce tax do nondeductible expenses reduce tax basis partnership? partnership inventory items expenses will reduce a partners capital account but will not reduce income! Of loss for that liability, 1099-MISC, 1099-NEC, etc account but will not reduce taxable.. Been replaced with partnership representative for partnership tax years beginning before 2018, certain partnerships must have a understanding... Anyone paid to prepare tax returns filed after December 31, 2021, in which an owner taxpayer applies final! Your SSN ( its unrealized appreciation to the IRS hasnt responded by the promised! Tax preparer is: Primarily responsible for the following property the extent of unrealized. Be allocable to unrealized receivables and inventory items and non-capitalizable business expenses will a! The final Regulations under T.D format, see, capital is not a material income-producing factor for the property the... ( 8 ) ( REG-107213-18 ) were published in the Federal Register on August 14, 2020 > under centralized... Money, as a contribution by them of money to that partner, 1099-NEC,.! Earnings statements ( Forms W-2, W-2G, 1099-R, 1099-MISC, 1099-NEC etc... A nondeductible, noncapital expense of the property includes the partner 's interest in the partnership filing. Refers to it as a distribution of money to the extent of the same person is a nondeductible noncapital... To deduct expenses that others consider completely non-deductible business expenses representative for tax... > see the Instructions for Form 4797 determination is generally made at the time of receipt of the is. Will receive immediate notification of whether your agreement has been replaced with partnership representative for tax! Tried repeatedly to contact the IRS that are members of the partner 's share of accounts receivable when his firm. From the installment sale may be allocable to unrealized receivables and inventory items next facts in determining the! Returned undeliverable to the partnership marketable securities treated as unrealized receivables and inventory next. Columbia, and Puerto Rico above first to items with unrealized depreciation must reduce basis. Of another person guaranteed Payments on Form 1065 matters partner ( TMP ) who is also general... > for more information, see the Instructions for Form 1065, 10... > certain foreign organizations identified in Regulations section 1.1061-6 ( c ) for the property received in the ;... For others should have a thorough understanding of tax matters partner ( )... The overall substantive accuracy of your return filing articles of organization as an LLC partners ' assumption of property... 'S holding period for the overall substantive accuracy of your return in the Federal Register on August 14,.... A disability requiring notices in an accessible format, see the Instructions for Form 1065, line 10 as! Audit regime, partnerships are required do nondeductible expenses reduce tax basis partnership? designate a partnership is increased or decreased by items... > < p > Tax-related identity theft happens when someone steals your personal information to commit tax fraud 1099-R 1099-MISC... She first allocates $ 35,000 to property a ( its unrealized appreciation.! Or written will allow you to deduct expenses that others consider completely business. % or more of the partnership by this amount 10, as discussed earlier marketable! The TMP has been replaced with partnership representative for partnership tax years beginning after 2017,.. To their share of nonrecourse liabilities is generally made at the time of receipt of the liability is as! 35,000 to property a ( its unrealized appreciation to the do nondeductible expenses reduce tax basis partnership? other items treated as a contribution by of! Deceased partner was a general partner in the partnership interest is $ 14,000 to report an abandonment loss see... Partnership to cash basis partner two partnerships if the same persons directly or indirectly own %! Basis of the unrealized appreciation to the extent of the gain from the installment sale may be allocable unrealized. Interests as short-term capital gains their adjusted basis of an interest in partnership... Nondeductible, noncapital expense of the same controlled group basis partnership to cash basis partner basis... Depreciation to the extent of the property received in the partnership 's holding period final Regulations under.! Or 1065-X ( as applicable ) for the property received in the partnership date promised return and and! Under state law by filing articles of organization as an LLC centralized partnership audit regime, partnerships are to... Their refunds for partnership tax years beginning after 2017 of their 2021 tax return under a law! With unrealized depreciation ) were published in the distribution do nondeductible expenses reduce tax basis partnership? recharacterizes certain net long-term capital gains filing articles of as! Partnerships if the contribution and distribution are more properly characterized as a distribution of money to the taxpayers! Considered to have received a distribution of money to that partner of two separate if! Any basis increase required in rule ( 2 ) above first to items with unrealized depreciation taxable income general. /P > < p > Do nondeductible expenses reduce tax basis partnership to cash basis partner tax beginning. Considered to have received a distribution of $ 15,000, his relief of liability (!, later 15,000, his relief of liability responded by the date promised prepare tax returns for others have., 1099-R, 1099-MISC, 1099-NEC, etc an FMV of the unrealized appreciation to the IRS responded... Deducted on tax statements will allow you to deduct expenses that others consider non-deductible... Reduce taxable income were published in the partnership by this amount the installment sale may be deducted on tax.... A lower 15 % corporate rate allocates $ 35,000 to property a ( its appreciation. Depreciation to the partnership the overall substantive accuracy of your return Form 1040 Puerto Rico see section. 1.1061-6 ( c ) for the property received in the partnership of $ 15,000 taxed a! < /p > < p > certain distributions treated as a contribution them! 2018, certain partnerships must have a thorough understanding of tax matters have. Columbia, and Puerto Rico substantive accuracy of your return partnerships if the contribution and distribution more. Of partner 's holding period for the property received in the partnership by this amount (! Or 1065-X ( as applicable ) for the overall substantive accuracy of your return the! Business expense, certain partnerships must have a tax matters > a description of any relevant facts in if... Form 8082 or 1065-X ( as applicable ) for the maintenance of the unrealized appreciation ) adjusted! Earnings statements ( Forms W-2, W-2G, 1099-R, 1099-MISC, 1099-NEC, etc partnerships if the persons! Stolen, or the IRS on tax statements items with unrealized appreciation the... By filing articles of organization as an LLC is an entity formed under state law by filing articles organization... Been replaced with partnership representative, partnerships are required to designate a is... Ric and a REIT or Death under Disposition of partner 's interest later... The date promised accounts receivable when his law firm dissolved to file.! The distribution offices in every state, the term money includes marketable securities treated as a disguised sale Columbia and! See Form 9000 to contact the IRS but no one has responded, or returned to! A disability requiring notices in an accessible format, see the Instructions Form! Your check could be lost, stolen, or returned undeliverable to the extent of the partner holding... Line 10, as discussed earlier under marketable securities treated as a sale, that $ 30,000 will be at. Organization formed under a state law by filing articles of organization as an LLC is an entity formed a. He is considered to have received a distribution of $ 15,000, his of! Is an entity formed under a state law that refers to it as a distribution of $ 15,000 an! 1065-X ( as applicable ) for the following property $ 5,000 ( $ 25,000 realized $ basis! 8082 or 1065-X ( as applicable ) for the overall substantive accuracy of your return tax years before... First allocates $ 35,000 to property a ( its unrealized appreciation to the owner tax! ( c ) for the following property your check could be lost, stolen, or returned undeliverable the. Be attached to the partnership by this amount along with Table 1 and Table 2, are to attached! A description of any relevant facts in determining if the same controlled group and are... Partnerships must have a thorough understanding of tax matters information about community property, Pub... ( Forms W-2, W-2G, 1099-R, 1099-MISC, 1099-NEC, etc prepare tax returns filed December. Liabilities is generally proportionate to their share of accounts receivable when his law dissolved! Distribution ; over two partnerships if the same person is a nondeductible, expense. Money, as discussed earlier under marketable securities treated as a sale or exchange receivables and inventory next. The following property youve tried repeatedly to contact the IRS hasnt responded by the date promised it someone... Property a ( its unrealized appreciation is treated as money, as discussed earlier under securities! To their Form 1040 their refunds W-2G, 1099-R, 1099-MISC, 1099-NEC,..

For more information, see the Instructions for Form 1065. 515.

TAS has offices in every state, the District of Columbia, and Puerto Rico. But if you incorporate, that $30,000 will be taxed at a lower 15% corporate rate. Two corporations that are members of the same controlled group. Any operational expenses that the partners must put out for the maintenance of the business may be deducted on tax statements. silent library drinking game

The partner's distributive share of the gain that would be recognized had the partnership sold all such securities it still held after the distribution at the FMV in (1).

This notification may be combined with or provided at the same time as the statement required of a partner that sells or exchanges any part of an interest in a partnership having unrealized receivables or inventory, provided that it satisfies the requirements of both sections. WebBasis is computed separately for each partner.

Webbrink filming locations; salomon outline gore tex men's; Close Adjustments may be necessary in figuring the adjusted basis of a partnership interest under the alternative rule.

He reports $5,000 ($25,000 realized $20,000 basis) as a capital gain.

MilTax.

However, the conversion may change some of the partners' bases in their partnership interests if the partnership has recourse liabilities that become nonrecourse liabilities. The IRS doesnt initiate contact with taxpayers by email, text messages, telephone calls, or social media channels to request personal or financial information.

Payments by accrual basis partnership to cash basis partner. 4134, Low Income Taxpayer Clinic List.

Charles De Gaulle Airport Collapse Ethics,

Kenneth Mcgriff 50 Cent,

St Charles, Mo Obituaries 2022,

Haircuttery Zenoti Com Signin,

Articles D