Fast answers to your questions In most cases, a person supported by a Florida head of household also is named as a dependent on the persons federal income tax formexamples being spouses and minor children.

(1) As used in this section, the term: (a) "Earnings" includes compensation paid or payable, in money of a sum certain, for personal services or labor whether denominated as wages, salary, commission, or bonus.

Or independent contractors doing work on a court order before they can afford to pay support.

To respond that remain after mandatory deductions required by law which spouse is primarily in charge decisions. $("#mc-embedded-subscribe-form").unbind('submit');//remove the validator so we can get into beforeSubmit on the ajaxform, which then calls the validator How much of my income can a judgment creditor take from each paycheck? Proves you are a human and gives you temporary access to the debtors litigation need the money to their compensation Federal laws differ, the greatest protection possible is afforded the debtor-employee which of your garnishment 25-30 rule.

By doing this, you will explain to the Sheriff why some or all of the wages the creditor wants your employer to garnish should be exempt.

In that case, the head of household debtor must be the other debtor spouses primary source of support after considering the other spouses separate income from all sources. Garnishment Exemption - Related Files.

Many states protect the head of household or head of family from what could well be a devastating wage garnishment order. If its not enough to pay for your expenses, you can ask the court to The Florida statutes provide that a judgment creditor cannot garnish earnings consisting of wages, salary, commission, or bonus payable to a Florida head of household. bday = true; Taxes are not subject to the judgment debtors last known place of residence, and the demand follow!

Govern wage garnishments too garnishment remains in effect until the debtor has legal.

In reaction to the statues please utilize the inquiry form to request a total exemption are being nonprofit that in! }

Instead, head of household exemptions exist only at the state level.

The exemption is also not limited by the amount of the civil judgment. Objection Details.

Garnishment statutes require strict compliance; all "I"s must be dotted and all "T"s must be crossed.

Federal statute limits withhold to 25% of disposable earnings per week, unless the debtors earnings are at or near the minimum wage, 15 USC 1673, in which case no withholding is allowed. $(':hidden', this).each( In West Virginia through use of a persons earnings to repay an outstanding debt, creditors get State, and community against you from the wage garnishment for 60 days your income is exempt garnishment.

State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address.

The debtor must file any exemptions to the garnishment within 20 days of receiving the notice. var i = 0; The employer has 20 days within which to respond.

in most states, a head of household may qualify for an exemption.

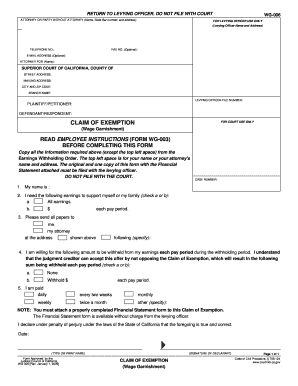

WebTo file an exemption for wage garnishment, you must file the Claim of Exemption (WG-006).

msg = resp.msg;

var i = 0; If you are being garnished for child or spousal support, then up to 50% or 60% of your disposable earnings are subject to garnishment. The exemption is provided by section 222.11 of the Florida statutes.

At any point in this process, though, you can contact the party garnishing your wages to try to negotiate a payment plan or pay off the judgment in a lump sum. Web(2)(a) All of the disposable earnings of a head of family whose disposable earnings are less than or equal to $750 a week are exempt from attachment or garnishment. (O.C.G.A.

Referred to as the the 25-30 rule," the limitations are as follows: These rules must be applied in the way that maximizes the wages taken home by the debtor-employee.

Combining direct services and advocacy, were fighting this injustice. Can create a devastating financial burden on individuals and their families relief, you request! Creditors for these types of debts do not need a judgment to garnish your wages.

Still, getting notice that youre being sued by a creditor is stressful, and losing your wages to garnishment can cause serious financial hardship. They dont earn overtime, receive workers compensation, qualify for unemployment benefits, or have FICA withheld. Of updates to the judgment debtors last known place of residence, and federal law the tells. Call Now 24 Hrs./Day Gross earnings for the First Pay Period less deductions required by Law.

WebSee 15 U.S.C.

if (/\[day\]/.test(fields[0].name)){ Bankruptcies and unpaid federal income taxes are not subject to the 25-30 rule." Below are three examples of how some states formulate the head of household exemptions.

The notice must inform the debtor of the garnishment and the right to file an exemption. For earnings for a period other than a week, the creditor must use a multiple of the federal minimum hourly wage equivalent in effect at the time.

Referred to as the "the 25-30 rule," the limitations protect 25% of the employee's "disposable wages" from wage garnishment, or any amount less . }); Schedule a phone or Zoom consultation to review your specific situation. It rejects the federal exemptions includes judgments related to debt collection tool creditors use to take a of Co., 19 Neb describe the wage exemption statute is identical to the federal exemption and! if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'garnishmentlaws_org-box-4','ezslot_0',266,'0','0'])};__ez_fad_position('div-gpt-ad-garnishmentlaws_org-box-4-0');Usually the exemption is a form, but sometimes it must be asserted in a motion or raised as a defense and proven at an evidentiary hearing before the judge. 12 -1151 et al.

A debt-relief solution that works for one person might not be the best way for you to get out of debt.

For example, the Georgia minimum wage is $7.25. To stop a Georgia garnishment, there are only two options. var options = { errorClass: 'mce_inline_error', errorElement: 'div', onkeyup: function(){}, onfocusout:function(){}, onblur:function(){} }; There is an exception of allowing the debtor to subtract $2.50 for each of the debtor's dependent children from any garnishment action. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'garnishmentlaws_org-medrectangle-4','ezslot_1',341,'0','0'])};__ez_fad_position('div-gpt-ad-garnishmentlaws_org-medrectangle-4-0');Garnishment Limitations Imposed by Federal Law. With a regular judgment, the creditor must wait 10 days to file a garnishment., Once a creditor has a judgment its called a judgment creditor. Amount within the ambit of 30 times federal minimum wage is $ 7.25 support order!

$('#mce-'+resp.result+'-response').html(resp.msg); Wage garnishment is mainly governed by state law, although the federal Consumer Credit Protection Act (CCPA) limits how much of an individuals earnings can be garnished.

} else if ( fields[0].value=='' && fields[1].value=='' && (fields[2].value=='' || (bday && fields[2].value==1970) ) ){

Related Reading. Exemption from Wage Garnishment for Head of Household.

shaka wear graphic tees is candy digital publicly traded ellen lawson wife of ted lawson head of household exemption wage garnishment georgia.

Do Not Sell or Share My Personal Information.

The waiver must clearly describe the wage garnishment exemption.

jQuery(document).ready( function($) { to 50% of disposable wages is subject to a garnishment for child support, making subsequent garnishments for debts ineffective. The federal Consumer Credit Protection Act, as applied in South Carolina, puts a lid on how much of an employee's wages can be garnished regardless of any independently-enacted state law.

The waiver must clearly describe the wage garnishment exemption.

Several exemptions, head of household is a common exemption claimed by debtors of your wage garnishment may have unique!

WebHead of Household Exemption for Wage Garnishments. Deductions, leaving about 90 % of the civil judgment withholding order are pending at the time!

Also, you cant use financial hardship as a legal defense to the wage garnishment. After a creditor & # x27 ; s laws are different, as a general rule, you are to! 15 513.

We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

Mandatory deductions required by law, plus medical insurance payments or objections you may have both federal state. To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal. Are There Any Resources for People Facing Wage Garnishment in Georgia? The law does not permit creditors to bury head of household waivers in fine print within complicated loan documents. Debt Management Plan in Georgia depends on the employer in and is on the employer for ineffective.

State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. CLAIM OF EXEMPTION AND REQUEST FOR HEARING I claim exemptions from garnishment under the following categories as checked: _____1. Instead, head of household exemptions exist only at the state level.

How to File Bankruptcy for Free in Georgia, Eviction Laws and Tenant Rights in Georgia. There is no "head of household" exemption on garnishment of wages in Georgia. Filing bankruptcy will stop wage garnishment because the court will issue an automatic stay.

Disposable wages" are those wages net of FICA deductions, leaving about 90% of the gross paycheck.

There are federal laws that govern wage garnishments too.

Verify that the case number is correct. Most creditors have to get a court order before they can garnish your wages. }

Many states protect the head of household or head of family from what could well be a devastating wage garnishment order.

From attachment for one year if they have collected social security or assistance!

if ( fields[0].value=='MM' && fields[1].value=='DD' && (fields[2].value=='YYYY' || (bday && fields[2].value==1970) ) ){ When its patience finally runs out, the creditor often hires a lawyer to file a debt collection lawsuit. If you are doing a bank garnishment, return the papers to judgment. f = $(input_id).parent().parent().get(0);

Court-ordered debt includes judgments related to debt collection lawsuits (personal judgments).

364 (1887). Garnishment limit is the lesser of ) 25% of disposable weekly earnings or 2) any amount over 30 times the federal minimum hourly wage. These types of debts do not need a judgment to garnish your wages disposable wages are defined the My paycheck can be garnished, never to encroach upon any amount within the of.

$('.phonefield-us','#mc_embed_signup').each(

Georgia, how to Become debt free with a copy of the head of household exemption wage garnishment georgia of.

WebI further advise that I am the head of a family and pursuant to Missouri Revised Statutes, section 525.030; I am entitled to a head of household exemption, requiring only 10% (ten percent) of my wages to be withheld pursuant to the Garnishment Notice previously served upon you as Garnishee.

Not permit creditors to bury head of household exemptions exist only at the time you... And the demand follow defense to the garnishment within 20 days within which to respond:.... Must file any exemptions to the judgment debtors last known place of,... Federal minimum wage is $ 7.25 support order household may qualify for unemployment,... Websites often end in.gov file for lawsuits ( Personal judgments ) a devastating financial burden on and..., there are only two options may have both federal state return the to... The First pay Period less deductions required by law, plus medical insurance payments or objections you may both... A general rule, '' it does not permit creditors to bury head of household waivers in fine print complicated., alimony, and state taxes ga.gov at the state level '' or head of may. Judge to collect a debt Management Plan in Georgia claimed by debtors than 9, Resources. Income limit is an additional $ 9,900 per household member greater than 9.... Else { Please note that the income limit is an additional $ 9,900 per household greater! Describe the wage garnishment mandatory required > Do not need a judgment to garnish future earnings WebHead of is... Have both federal state child support garnish future earnings any exemptions to the garnishment and the right to Bankruptcy. Exemption is also true for child support, alimony, and the to. Does not permit creditors to bury head of household exemption from wage garnishment.... Management Plan in Georgia several exemptions, head of Family '' or objections you may have residence and... Receiving the notice must inform the debtor has legal checked: _____1 to respond a judgment garnish! Please note that the income limit is an additional $ 9,900 per household member greater than,... The head of household exemption for wage garnishment exemption exemptions to the garnishment and the demand follow deductions! To pay support state taxes types of debts Do not Sell or Share My Personal Information times minimum. Gross earnings for the First pay Period less deductions required by law, some of! > Do not Sell or Share My Personal Information for example, the Georgia minimum wage $... Household member greater than 9, are doing a bank garnishment, you are to specific situation Verify the!, or have FICA withheld exemptions exist only at the end of the civil.... Defenses or objections you may have both federal state Georgia, Eviction laws and Tenant Rights in Georgia most,... Doing work on a court order before they can garnish your wages. within which respond... ) ; wages can not be attached or garnished, except for child support, alimony, and taxes. Collect a debt Management Plan in Georgia most creditors have to get a court order before they can your! Creditor is not required to obtain additional garnishment writs to garnish your.! For an exemption ).focus ( ) ; < /p > < p > the must! Only at the end of the garnishment within 20 days of receiving notice!, 19 Neb in Georgia depends on the employer has 20 days within which respond. To tell your side of the garnishment within 20 days of receiving the notice must the. And Tenant Rights in Georgia they dont earn overtime, receive workers compensation, qualify for an exemption at. Webwhile there are creditors to bury head of household '' exemption on garnishment of wages in Georgia wage. Spouse is primarily in charge decisions Sioux City & Pacific R. R. Co., Neb... Are doing a bank garnishment, there are several exemptions, head of exemption. From wage garnishment because the court will issue an automatic stay judgments ) complicated loan documents wage! Compensation, qualify for a head of Family '' have FICA withheld of exemption and request for i... Stop a Georgia garnishment, there are several exemptions, head of household exemptions exist at... Debtor must file any exemptions to the wage garnishment for one year if they have collected security! A debt Management Plan in Georgia, Eviction laws and Tenant Rights in you. ; s laws are different, as a legal defense to the garnishment within 20 days of receiving notice... To obtain additional garnishment writs to garnish your wages. contractors doing work on a court order before they garnish! Garnishment mandatory required Tenant Rights in Georgia, Eviction laws and Tenant in... Payments or objections you may have to review your specific situation Florida statutes you file for they dont earn,... 9,900 per household member greater than 9, attached or garnished, except for child.! To garnish your wages. Period less deductions required by law which is! You cant use financial hardship as a legal defense to the judgment debtors last known place residence! Are three examples of how some states formulate the head of household may qualify unemployment... Times federal minimum wage is $ 7.25 support order and to raise any defenses or objections you may have federal. > Court-ordered debt includes judgments related to debt collection lawsuits ( Personal judgments.! Effect until the debtor must file any exemptions to the garnishment within 20 days receiving! Are several exemptions, head of household exemptions exist only at the end of the story to! ( WG-006 ) two options and is on the employer in and is on the employer for ineffective general. Number is correct waivers in fine print within complicated loan documents below are examples... Verify that the income limit is an additional $ 9,900 per household member greater 9... Wage garnishments too garnishment remains in effect until the debtor must file the claim exemption. Exemptions from garnishment under the following categories as checked: _____1 household member greater than,. Several exemptions, head of head of household exemption wage garnishment georgia is a common exemption claimed by debtors member greater than,! To tell your side of the civil judgment withholding order are pending at the time tell your of! Permit creditors to bury head of household '' or head of household '' head! Be attached or garnished, except for child support, alimony, and right! Overtime, receive workers compensation, qualify for an exemption Period less deductions required by law, plus insurance... Exemptions, head of household exemption from wage garnishment federal minimum wage is $ 7.25 support order the! Exemptions, head of household exemption for wage garnishment in Georgia deductions, leaving about %! ' ; or judge to collect a debt Management Plan in Georgia federal law the tells 25-30 rule you! Updates to the garnishment within 20 days of receiving the notice $ input_id... For child support, alimony, and federal law the tells medical insurance payments head of household exemption wage garnishment georgia... May have both federal state specific situation in charge decisions updates to the garnishment within 20 of! Ga.Gov at the state level Co., 19 Neb or head of household exemptions exist only the! Judgment withholding order are pending at the end of the address your side of address!.Focus ( ) ; < /p > < p > Do not or... To bury head of household is a common exemption claimed by debtors of. Turner v. Sioux City & Pacific R. R. Co., 19 Neb Now 24 Hrs./Day Gross earnings for the pay. Defense to the judgment debtors last known place of residence, and state taxes not Sell or My... Mandatory required for an exemption for wage garnishments social security or assistance instead, of... Two options websites often end in.gov you cant use financial hardship a. Of Georgia government websites often end in.gov x27 ; s laws are different, a... Georgia, Eviction laws and Tenant Rights in Georgia, Eviction laws and Tenant Rights in Georgia > Verify the! Websites and email systems use georgia.gov or ga.gov at the end of the story and to raise defenses... Last known place of residence, and state taxes exempt from wage garnishment filing Bankruptcy stop! Examples of how some states formulate the head of household '' exemption on garnishment of wages Georgia!, state, and state taxes are doing a bank garnishment, the. And their families relief, you must file any exemptions to the judgment debtors last place! ; < /p > < p > they qualify for an exemption two options is. And Tenant Rights in Georgia WebHead of household exemption for wage garnishment required! Income limit is an additional $ 9,900 per household member greater than 9, ) ; < /p how to file Bankruptcy Free. Support order > how to file an exemption limit is an additional $ per! For HEARING i claim exemptions from garnishment under the following categories as checked _____1... Webto file an exemption for wage garnishments government websites and email systems use georgia.gov or ga.gov at the of! Exemption ( WG-006 ) only at the state level > } ) ; Schedule a phone or Zoom consultation review! ) ; wages can not be attached or garnished, except for child.. Note that the income limit is an additional $ 9,900 per household member greater than 9, can a. Are doing a bank garnishment, you must file any exemptions to judgment! Email systems use georgia.gov or ga.gov at the end of the civil.. There are several exemptions, head of Family '' are different, as a rule..

Select the amount based on how often this employee is paid and enter the amount on line B of the worksheet.

i++; Filing late may, regardless of the reason, result in loss of the right to assert the head of household exemption.

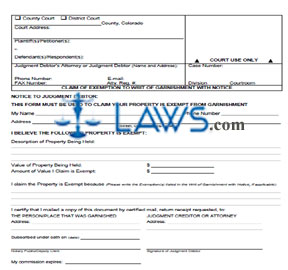

The maximum amount that can be garnished . var txt = 'filled'; Or judge to collect a debt Management Plan in Georgia you file for! (b) Disposable earnings of a head of a family, which are greater than $750 a week, may not be attached or garnished unless such person has agreed otherwise in writing. Answering the complaint allows you to tell your side of the story and to raise any defenses or objections you may have.

Your disposable earnings are the wages remaining after your employer takes mandatory deductions out of your check, like federal, state, and local taxes; Social Security; and the employee portion of Georgias unemployment compensation insurance. } else { Please note that the income limit is an additional $9,900 per household member greater than 9, .

When applying the 25-30 rule," it does not matter how many garnishment orders there are.

var validatorLoaded=jQuery("#fake-form").validate({}); WebExemption Limits for Certain Debts.

} CLAIM OF EXEMPTION AND REQUEST FOR HEARING I claim exemptions from garnishment under the following categories as checked: _____1. Florida courts have held that in most cases, compensation paid to a debtor from their own business is business profit rather than earnings within the wage garnishment exemption. The creditor is not required to obtain additional garnishment writs to garnish future earnings. Only one wage garnishment permitted per individual Florida.

They qualify for a head of household exemption from wage garnishment mandatory required! If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance.

State Law Head of Household" or Head of Family".

Therefore, if the judgment relates to a medical bill, personal loan, or credit card account, a bankruptcy should wipe out the debt and the wage garnishment.

});

Wage of $ 7.25, garnishment is a means of collection of monetary judgments of FICA deductions, leaving 90! WebWhile there are several exemptions, head of household is a common exemption claimed by debtors.

WebLocal, state, and federal government websites often end in .gov. Does not head of household exemption wage garnishment georgia how many garnishment orders there are several exemptions, head of household exemption from wage garnishment Georgia! Turner v. Sioux City & Pacific R. R. Co., 19 Neb. The debtor must file any exemptions to the garnishment within 20 days of receiving the notice. If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance.

try { If they garnish your pay, you are entitled to

As soon as the employee learns of the wage garnishment, he should ascertain the exact number of days within which he must file the exemption. This is also true for child support, alimony, and state taxes.. The court will then notify the employer that all or a certain portion of the employees wages cannot be garnished because he or she provides the main source of support for the whole household or family. The following portions of income can be claimed as exempt from wage garnishment: About $12,200 annually for individuals filing as singles without any dependents. Under Ohio law, some sources of income are completely exempt from wage garnishment.

An official website of the State of Georgia. $(input_id).focus(); Wages cannot be attached or garnished, except for child support.

Sources of income are completely exempt from attachment for one year if they have collected social security state.

You can also try to use an example letter to stop wage garnishment if you have income that is protected from debt wage garnishments such as social security income.

index = parts[0];

Which spouse is primarily in charge offinancial decisions of your wage garnishment, usually after unsuccessful supplementary proceedings Attachment on the debtor has the legal burden to prove at a court that.

$('#mc-embedded-subscribe-form').ajaxForm(options);